The Ultimate Guide To Frost Pllc

The Ultimate Guide To Frost Pllc

Blog Article

The Best Strategy To Use For Frost Pllc

Table of ContentsOur Frost Pllc IdeasThe Basic Principles Of Frost Pllc The Definitive Guide to Frost PllcFacts About Frost Pllc UncoveredFascination About Frost Pllc

Today, people analytics are incorporated right into numerous HRMS. They help HRs recognize trends, such as attrition, involvement, and performance degrees, and take corrective activities.

Smaller sized companies have flatter styles for faster decision-making and adaptable operations. There are numerous legal structures. The single proprietorship is ideal for solo specialists starting. Partnerships supply shared possession and duties. Whereas, a limited obligation company combines obligation security with the adaptability of a partnership. A much more complicated framework entails an S corporation, better matched for larger companies.

10 Simple Techniques For Frost Pllc

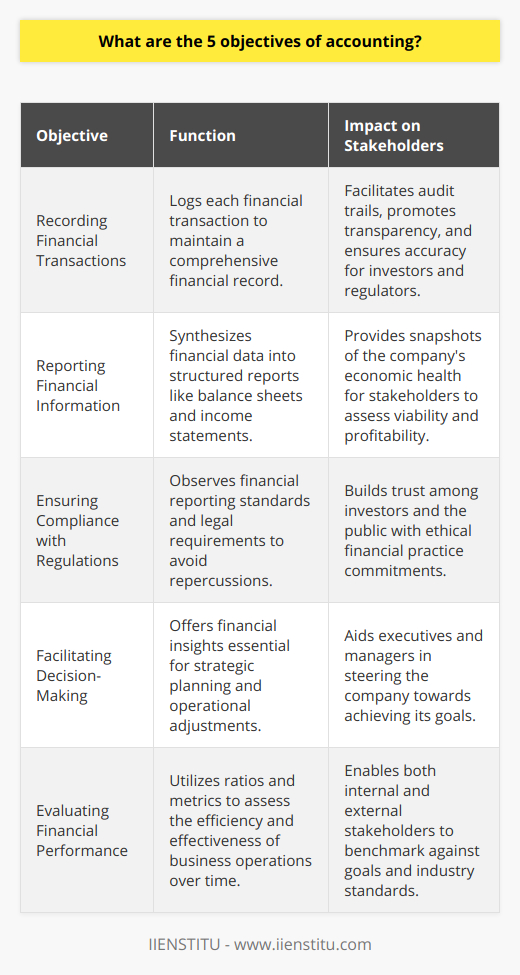

The execs under them include personnel accounting professionals that specialize in unique locations of accountancy. It additionally measures, handles and connects financial data to different celebrations. By studying monetary papers, accountancy aids with decision-making, preparation and adhering to the legislation.

Via audit techniques, stakeholders can fairly assess a firm's economic setting. An intriguing story makes evident the importance of audit.

Example of bookkeeping: The instance of audit can be seen with a thorough table that demonstrates the financial purchases and statements of an organization. By following to these principles, people and businesses can guarantee precise bookkeeping, visibility, and wise decision-making. They supply an usual language for finance pros, enabling them to speak efficiently with stakeholders and analyze accounting data intelligently.

This requires organizations to sign up earnings and expenses when they are gotten or spent, not when money is accumulated or paid. Frost PLLC. This guarantees financial declarations demonstrate a business's true monetary situation anytime. An additional important principle is consistency. This mentions that when a bookkeeping method has been chosen, it needs to be regularly used in all monetary reporting periods.

The principle of materiality emphasizes that only distinctive info must be consisted of in monetary declarations. Comprehending these essential audit principles is crucial for every person in money, such as accountants, investors, and service proprietors.

Record Purchases: Obtain all financial tasks properly and in a time-sensitive means, seeing to it each purchase is appointed to its equivalent account. Hold Ledgers: Have specific ledgers for every account, permitting for specific tracking and study of deals. Fix Up Accounts: On a regular basis contrast tape-recorded deals with bank statements or other outside resources to identify any kind of inconsistencies.

Getting The Frost Pllc To Work

To make certain financial declarations are precise and meaningful, adhere to these ideas: Consistent Audit Plans: Use the very same policies over various periods for easier contrast. Accurate Record-keeping: Maintain track of all transactions for reliable and reliable statements.

It also assists organizations evaluate their economic stability, examine profitability and plan for the future. Audit is a language of company. It documents and reports monetary purchases precisely, enabling stakeholders to assess company performance and setting.

In enhancement, audit permits various divisions within a company to interact properly. Dependable bookkeeping techniques assure conformity and supply data to identify my response growth opportunities and prevent threats.

Via accountancy, it can track sales profits, deduct the price of products sold, and allot costs such as rent and wages. Frost PLLC. This analysis helps identify the most successful products and educates future getting and advertising strategies. Accountancy plays several crucial functions in business, consisting of financial record-keeping, preparing monetary statements, budgeting, tax conformity, and interior control implementation

Frost Pllc for Beginners

Report this page